As UX Lead for MCD Partners, Chicago, my role was to engage more directly with our clients to help assess their experience needs. This included coordinating research activities for shaping strategic recommendations, moderating working sessions, workshops and design studios, formulating testing plans for our usability lab, and managing UX resources across design execution.

We focused on a collaborative, lean UX model based on problem-space definition, consensus-building through collaborative workshop activities, and rapid, iterative design processes such as design studios.

We focused on a collaborative, lean UX model based on problem-space definition, consensus-building through collaborative workshop activities, and rapid, iterative design processes such as design studios.

|

Discovery Workshops

Generative workshops focused on balancing Customer Needs and Business Goals while aligning functional requirements and technical capabilities. |

Design Sprints

Leveraging iterative sketching and storyboard processes to engage the client in the design process, define outcomes, and build consensus on design direction. |

Rapid Prototyping and Evaluation

Getting to tangibility faster and getting in front of users to learn about the effectiveness of our designs for iteration and expansion. |

|

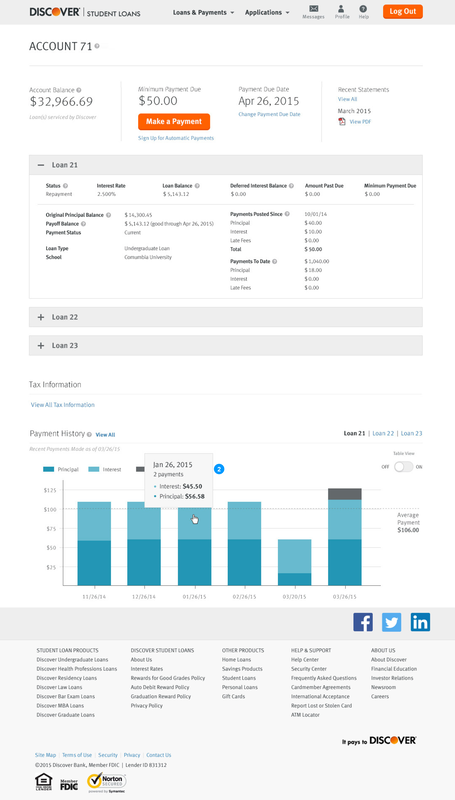

Discover Student Loans

Goal: Launch a net new product for servicing and payments of student loans under the DSL banking product. Challenge: Identifying and mapping the various payment scenarios and workflows for managing student loan payments for a variety of different student loan personas. Approach: Critical to the work was understanding the range of different payment scenarios (and payment methods) and associated workflows for managing student loan payments for a variety of different student loan personas. As in any regulated context, repayment rules for student loans varied greatly based on origination and terms, and understanding the specifics of each, and where customers may be in repayment on multiple different loan types, required extensive co-creation with clients and experts to map each flow and scenario. From there we built interactive end-to-end prototypes to validate with customers and define our product roadmap priorities and shepherd detailed design through initial development and iteration in production. |

|

Discover Bank

Goal: Prepare for Discover Bank's transition from a member-only benefit for cardmembers to a premium broad-market financial service. Challenge: Identifying customer and business needs that would enable Discover to be successful in the marketplace. Approach: Extensive research track to identify target customers, understand how they bank in the 21st century, and define opportunities for Discover to leap past their competitors. Modern banking extends beyond segments, and is struggling to fit the lifestyles of younger customers. Developing a rich understanding of how these customers wish to connect to banks, on a personal level as well as on an account management level, was integral to the process. Defining the customer journey from the initial engagement level and across their relationship helped identify opportunities outside of the traditional banking realm. Concepts leveraged not only best practices from the financial service industry, but also from social media and fitness platforms as well. |

|

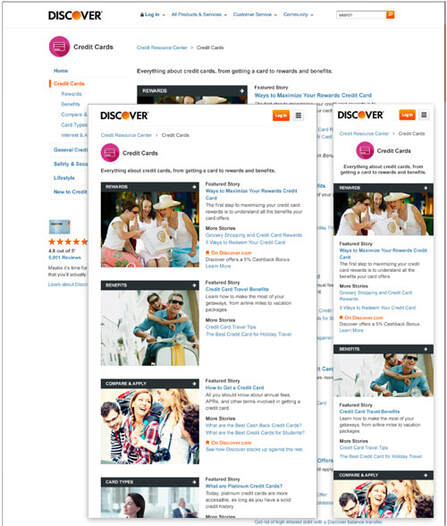

Credit Resource Center

Goal: Create an easily navigable, scalable, and responsive credit resource center that provides content about credit cards and general credit information. Challenge: Defining a content strategy that supports user goals, consolidated in a clear, easily understood taxonomy, that supports bright, engaging content templates in a responsive framework. Approach: Paramount was understanding the user needs around gathering information about credit. How do those content needs change over time and from person to person? Research into these user groups and their needs helped inform the structure of the site. Iterative sketching and collaboration yielded multiple approaches, gradually consolidated into the final design. |

|

Enterprise Rewards

Goal: Increasing transparency of marketing programs by adding unique tracking visualizations as part of an integrated rewards program for Discover Card Members. Challenge: Balancing visualization elements to craft distinct trackers relevant to the offers members are enrolled in without overloading them with too many competing elements. Approach: Research on goal acquisition and visualization strategies across other contexts - namely fitness tracking and other tools - and how users are using those tools. Rapid iterative design and prototyping, iterative user testing (RITE method). |